Research and information are one of the most critical aspects to finding the best stocks in the market. But, it’s impossible to look at every stock available in the market because there are thousands of companies, small and large, trading in the market. So, how do traders find stocks that have potential?

Luckily for traders, it’s more science than art, and you don’t have to look at each company one by one to find good trades. But that is what we will be going over in this article; we will discuss the importance of scanners and why you should consider using them to find high-quality stocks that meet your trading criteria.

Is the Voodoo Mastery Right for you?

Henry and I have teamed up and created a program using the voodoo lines to map out the market. Sign up today and join the Voodoo Mastery Program, and learn from the pros who are the masters of their trade. Get access to live trading with Henry and David, get real-time trade alerts, and follow along with their spreadsheet of stocks that interest them. Become a member of the Voodoo Mastery Program and never trade alone again.

Video Guide to Scanning stocks

What is a Stock Scanner?

Stock scanners are computer software that can evaluate features on a stock chart that can meet specific criteria created by the trader. Computers can go through a vast amount of companies in a short amount of time and make a watch list geared toward your setup and strategy. Traders can then focus on what matters to them instead of focusing on trades that aren’t going to lead anywhere any time soon. Like anything in the market, there are many scanners available, and they are all different.

Benefits of the Various Scanners:

- Some can identify price patterns and candlestick patterns.

- Other scanners can work directly with indicators built within the software; Indicators, such as moving averages, oscillators, relative strength index (RSI), and trending indicators like DMI and ADX.

- Some scanners work with custom indicators which work well with Simpler Trading’s proprietary tools like the Squeeze Pro, and Ready.Aim.Fire!® Pro, and 10x Bars.

Researching the type of scanner you would like to use is crucial. Traders need to find the kind of scanner that fits their style and strategy and learn how to use it to find the right stocks that match their criteria.

Stock Scanner vs. Stock Screeners

Stock scanners and stock screeners are often used interchangeably, and it’s understandable they both review many stocks and reduce them to a smaller list. However, they have differences that traders need to understand before using them in the market. It can make a big difference when finding stocks that meet your criteria.

Stock Screener

Stock Screeners are mainly used for analytical purposes, as they generally focus on stocks that traders wouldn’t see on a chart. For example, they focus on the company’s sector, the price-to-earnings ratio (P/E Ratio), dividends, and the average analyst opinions. Screeners contain some measures, such as volume and price, which appear on a chart, but they give the trader basic information.

Stock Scanner

Stock Scanners are mainly used for technical purposes. Generally speaking, stock scanners have some of the same features, but it shows those features on the charts. When researching a stock screener and a stock scanner, ensure you know exactly what you are looking for; as we have stated earlier, stock scanners and screeners often get mixed up. It’s best to focus on the specific features you need when looking in the market. So that way, you won’t get confused if you need a screener or a scanner.

My Favorite Scanners to Use

- Thinkorswim – is a powerful and flexible scanner. However, there is a learning curve to using this scanner proficiently; the trader will need good technical experience.

- TradeStation – this scanner is also powerful and flexible; there is also a learning curve, and it will require technical experience to use it properly.

- Simpler Trading Scanner – the Simpler Trading Scanner is a web-based application that can find setups and be used by any trader regardless of what platform they are using. However, there are not many flexible ways to customize your scans, but it is preset with many setups the professionals have found to be effective.

How to Scan Stocks for Options

When I am scanning for options, I want to find setups like the stock chart below. We will be using Arch Resources (ARCH) for this example. When buying calls or puts, an options trader has the directional consideration of a stock trader. But the trader needs to understand that the underlying stock needs to move fast enough to make money before Theta Decay kicks in or expires.

John Carter’s Squeeze Pro is an excellent tool for this purpose. In the chart above, you can see that the stock was in an uptrend. Once it entered into that consolidation, the Squeeze Pro started to turn red. Indicating that it appears to be a good spot to make a trade. Once it broke out of the consolidation, there were consecutive days of sharp moves upward. It’s a fantastic trade for calls because of how quickly the trend line moved up.

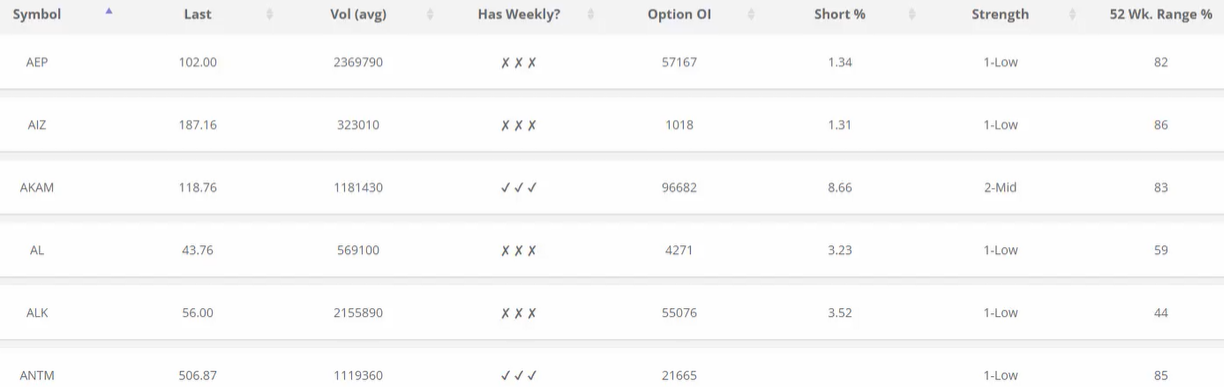

However, before the stock moved up, on April 11, 2022, the stock setup appeared on the Simpler Trading Scanner. In the graphic below, it does not show the ARCH trade, but it does show the following:

- Stocks in an uptrend

- With a daily squeeze

- And a potential to have sharp movements out of consolidation

How to Scan Stock for Day Traders

When day traders scan for stocks, they operate under different requirements; since day traders have to work fast, they tend to focus on liquid stocks. One approach day traders scan for setups is using a 15-minute squeeze or voodoo lines in the trend of your target.

Another way traders can scan for stocks is using a longer time frame. Day traders can start the night before or early in the morning to build a list of stocks that looks promising. When the opening bell rings, the day trader can start watching each stock they have scanned and execute a trade when they find their criteria being met. However, this is where discipline and patience come into play; it’s a constant routine to find stocks that meet your criteria, so you can decide to trade.

Scanning stocks can help identify suitable candidates for stocks. But, traders will need to know what type of setups they want to trade. Traders need to have a good solid understanding of what they are comfortable with to trade with confidence. Once you have the setup down, you will want to find the best scanner or screener to find stocks. Once you have those situated, you should be all set to start scanning.

FAQs on Scanning Stocks

A: Follow this link to the shared chart which will get you set up with the basic chart setup, look and feel that you will see on John’s charts. Copy and paste this shared link https://tos.mx/F5XE5sa into Thinkorswim (TOS). Please go to: Setup > Open Shared item > paste link into Shared item URL: > Open.

A: Voodoo lines are used for important support and resistance levels and price targets.

A: The best way to scan for momentum stocks is by looking for opportunities, that are yielding higher returns than the overall stock market, and fit your timeline to trade.

A: The Ichimoku Cloud has been one of the most reliable and powerful indicators I’ve used. It’s free and available on most trading platforms. It represents the gray “cloud” that combines multiple points of data to give a current and future projection of support and resistance.

A: Yes. While you should rely on your trading plan and many other factors, indicators play a big role in your decision-making, as they drive the technical analysis of trade.