What is a debit spread?

If you’re new to options trading, you may have heard the term “debit spread” thrown around. But, what is a debit spread, and how does it work? In short, a debit spread is an options trading strategy that involves buying one option while simultaneously selling another option at a higher strike price, resulting in a net debit to your account. This strategy can be used to limit your risk while potentially maximizing your profits.

Let’s explore this trading strategy in more detail and see how it can be used to achieve your trading goals.

KEY TAKEAWAYS

- A debit spread is an options strategy where you buy and sell the same underlying stock using different strike prices of the same expiration date.

- When a debit spread is placed, the investors’ account will be charged a net debit, hence the name of the strategy.

- This strategy is similar to other spread strategies, such as a credit spread, but the core concept differs.

- A debit spread is an options strategy that works best when the implied volatility is below 50%.

Debit spreads

A debit spread is an options strategy that yields a net debit to the investor’s account when placing the trade. The debit is the cost that it will take to place the trade. This is a very beginner-friendly, small, account-friendly strategy due to a lower capital requirement for placing a trade. There are both pros and cons to utilizing the vertical spread strategy. One of this strategy’s most significant disadvantages is that time is your enemy. This strategy is often confused by being only bullish or only bearish. Depending on how the trade is configured, this strategy can be either bullish or bearish.

The most significant difference between a vertical credit spread and a vertical debit spread is that with a debit spread, you need the underlying stock to move in the anticipated direction. When placing a debit spread, you need the underlying stock to advance in your favor, whereas in a credit spread, you don’t need it to go against you to a certain extent. Credit spreads also have time decay on their side when a debit spread does not.

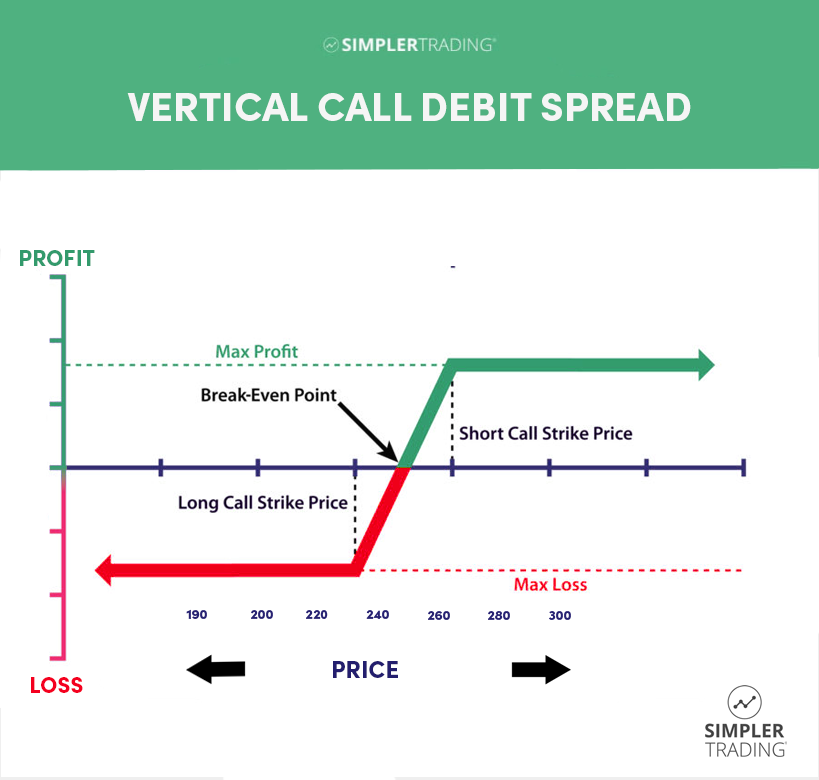

This illustration explains how the profitability curve is held within a vertical call debit spread. In this example, it is a bullish vertical call debit spread, but the image would look the same for the inverse.

The first thing that needs to be noted is that the point of profitability requires the underlying stock to move toward the anticipated direction. You start the trade in a losing position, but as the underlying stock begins to advance in your favor, you eventually reach break-even and profitability.

This Image also shows the max profit and loss by illustrating a flat line at the top and the bottom of the profitability scale. As you can see, the loss is anywhere between $1 and the max loss. On the other hand, the total gain can be anywhere between $1 and max profit. The final return on this trade will be somewhere between max loss and max profit, depending on where the underlying stock price closes at the expiration of the options.

Debit Spread Example

An example of a call debit spread is when, theoretically, a trader buys a single call option for $3.00 in premium. For the other leg of the position, the trader sells another single call option with a different strike price on the same underlying stock for $2.00 in premium. The difference between the $3.00 strike option and the $2.00 strike option yields a debit of $1.00 in premium. The total cost of the trade will be $100 to place. This number is calculated by taking the difference ($1.00) and multiplying it by the number of shares in a single contract (100).

In this example, the investor assumes that the underlying stock will move higher and ultimately beyond the strike being sold for maximum profit. The best-case scenario is that maximum profit is rewarded by the stock being at or above the sold strike at the expiration time.

In this example, you are trading a stock currently at $100 if you buy the $105 call and sell the $110 call. This $1.00 debit is added to the strike price you bought to calculate the break-even point. In this example $105 strike + $1.00 in premium = $106 in the underlying stock.

To calculate the max profit in this trade, you will take the strike you sold minus the strike you bought minus the debit premium. In this example, it would look like this: $110-$105 = $5, Then $5 – $1.00 = $4.00 in max profit for this given trade.

Depending on the final price of the underlying stock at expiration, as long as it is beyond the break-even point, the profit potential can be between $1 and $400 in this given example. Once again, maximum profit will be achieved if the underlying stock closes beyond the sold strike at expiration.

The maximum loss is always limited to the debit paid to enter the trade. Having a defined max loss is one of the benefits of utilizing this strategy.

How to place a debit spread trade

The first step to placing a debit spread is to identify the direction in which you believe the underlying stock will move.

Once you have identified a direction, the next step is to determine the size of the move that you anticipate the stock to move to select the strikes that you will be buying and selling.

After determining the strikes that you will be using, you need to determine the amount of time the setup will need to play out. This step is crucial because, in a debit spread, time is not your friend but actively works against you.

Finally, you place the trade by buying-to-open (BTO) the long call option and selling-to-open (STO) the short call option.

To exit the trade you will need to sell-to-close (STC) the long call option and buy-to-close (BTC) the short call option.

Why trade debit spreads

The biggest reason to take a vertical debit spread is to take part in a directional move without paying the same premium as a naked option strategy. Utilizing this strategy limits the gains that can be achieved and reduces the amount at risk of losing. When taking a vertical debit spread, both the max loss and profit are predefined; this also helps an investor properly manage their risk and fully understand the trade possibilities.

CONCLUSION

Every trader has different goals, risk tolerance, and trading styles. This means not every strategy is going to be universally accepted. Some strategies may work better than others for specific traders, and some may not. It is essential to understand your strengths as a trader and what the strength is of any given options strategy you plan to deploy. This strategy has the strength of partaking in a directional move with a limited loss and a limited max profit. This options strategy is a cheaper alternative to playing a directional movement naked and has its benefits, Such as the more affordable entry price and lower max risk.

FAQ’s

A debit spread is an options trading strategy that involves buying one option while simultaneously selling another option at a higher strike price, resulting in a net debit to your account. This strategy is used to limit risk while potentially maximizing profits.

The purchased option and the sold option are both in the same underlying security and have the same expiration date. The sold option has a higher strike price than the purchased option, resulting in a lower cost to enter the trade.

Debit spreads are typically used when a trader expects a modest price movement in the underlying security. By using a debit spread, traders can limit their risk by capping their potential losses while still maintaining the potential for profit.

Overall, debit spreads are a popular trading strategy because they offer a way to limit risk while still having the potential to profit from price movements in the underlying security.

A debit spread can be either bullish or bearish, depending on how you set it up. A bullish vertical call debit spread is created by buying a call closer to the money (or deeper in the money) than the call that is being sold. Conversely, a bearish vertical put debit spread is created when you buy a put closer to the money (or deeper in the money) than the put being sold.

An investor may use a debit spread in a situation where the volatility is below the 50% percentile. These trades are also taken when you have a directional bias. A debit spread can be cheaper than playing a naked directional option with time on your side. Options can become expensive the further from expiration you are, so this can be an excellent alternative to take place in the move at a cheaper cost.

A debit spread may be worth it based on your personal trading style. Only you can answer this question, but we can lay out the pros and cons for you to analyze and then decide on your own. The pros include a predictable maximum loss, a predefined max loss, and a cheaper point of entry than some other trading strategies. The biggest con many traders will point out is that the greeks are not on your side. Time, or theta, is actively working against you as the expiration date approaches. If you are a trader that is more comfortable going against the greeks, this strategy is an excellent beginner-friendly way to take part in a directional move.