How To Trade Credit Spreads

Nothing in the stock market is immune to risk but traders may have found one of the safest ways to trade options, and that would be through credit spreads. Option Credit spreads are a valuable way for traders to generate income in the world of options trading.

The only real drawback to credit spreads is that you can’t make a ton of money trading this strategy. It’s simply a way for traders to create a consistent cash flow that offers low risk. Aside from the income aspect of credit spreads, it’s also a good way to ease into options trading. So, let’s get into credit spreads and see if this strategy can benefit you.

Do You Want to Be a Better Trader?

Even though credit spreads are a great way to make additional income, it still comes with a learning curve that traders need to be aware of. If you are struggling to grasp the concept of Credit Spreads and other options strategies I recommend you join my Stacked Profits Mastery Program. If you sign up today, you will gain immediate access to my monthly live trading session, real-time push alerts, and my very own trade spreadsheet.

Why Trade Option Credit Spreads?

What are Credit Spreads?

Option credit spreads require a trader to sell a high-premium option and then, at the same time, buy a lower-premium option. Both options will have the same expiration date. In order for this strategy to work, the premium received from selling the high-premium should be greater than the option that was paid for. When done correctly, this will result in a net credit that the trader gets to collect.

Is Credit Spreads Right for You?

Hypothetically speaking, everyone can benefit from Credit spreads. But depending on your strategy and risk tolerance, credit spreads may be more suited for traders looking for income or, beginner traders looking to get into options.

If you don’t fall under these two categories then you might want to look for a strategy that suits your risk level, especially if you have a higher tolerance for risk. If you are a trader that’s looking to make a huge gain in the market, then this strategy isn’t for you. The most you can make in profit is the net credit that you have received via premium. In fact here are the pros and cons for you to weigh the benefit for you.

This is a Great Strategy to Utilize When

- You want defined risk

- You believe equity will stay above a specific price

- You want to sell premium, instead of buying it

- You want a strategy to even out the positive deltas you’ve purchased

- You want a relatively stress free strategy

Pros and Cons

What is Theta Decay?

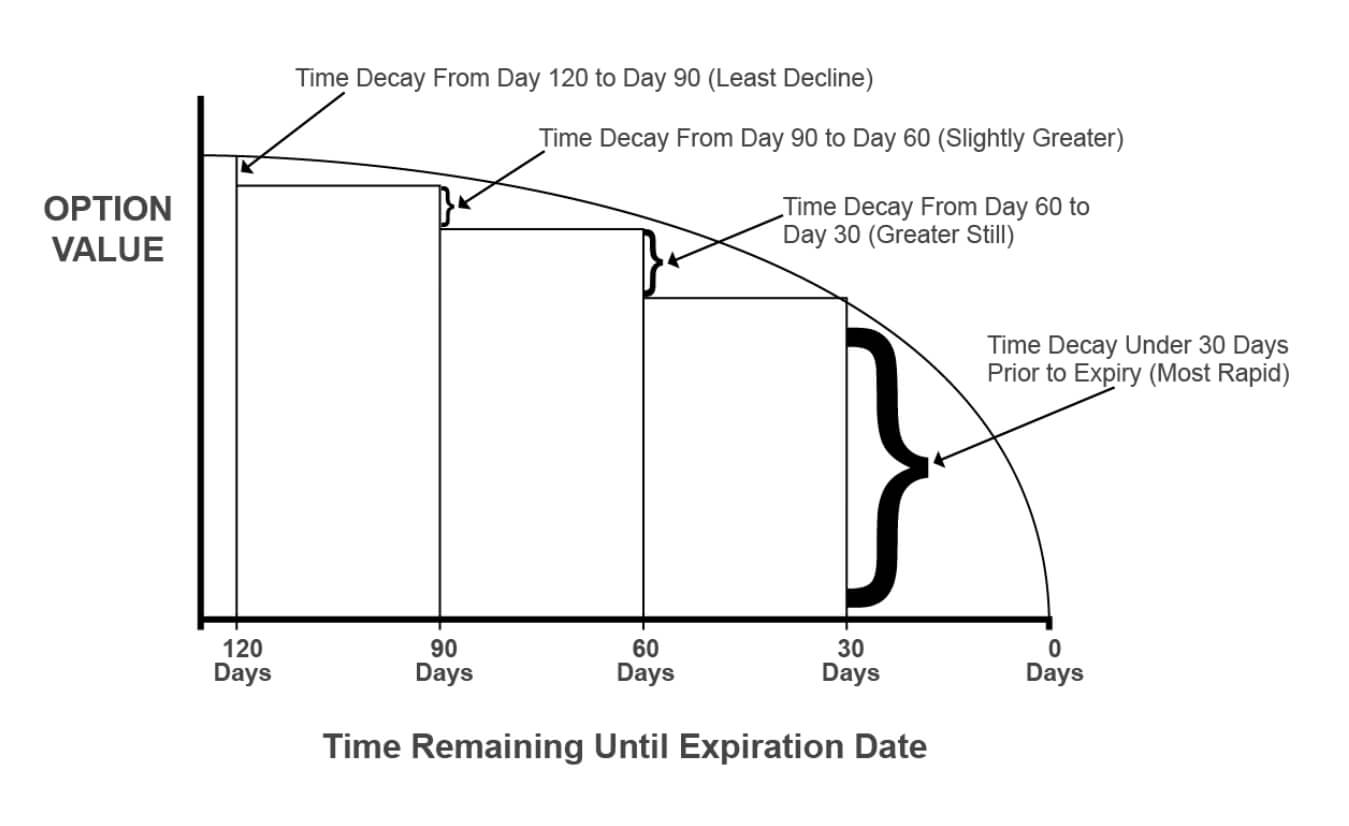

Theta Decay essentially calculates the amount of change in value an option has undergone. For example, if the theta decay of an option is $0.25, then the option will decline 25 cents a day. But, Because all options contracts are equal, 100 shares of an underlying asset the option value will lose $25 a day. For sellers of an option, theta decay is a good thing to have since the value of the option declines which gives sellers an advantage over the buyer.

Below I have provided a visual example of how Theta Decay works:

Best Credit Spread Strategies

The two most popular credit spread strategies are put credit spreads and call credit spreads. I feel like these are the best strategies that traders can use on the market because of the simplicity that really popularizes them amongst traders. Options can get complex very quickly, but when you have money on the line, it’s sometimes best to stay out of the weeds and focus solely on your goals.

When you are getting into credit spreads it’s essential to understand that you can’t just jump into any stock and start buying and selling options. There is a net premium that can be made but you still need to do research.

That may be pretty obvious, but don’t let easy money cloud your judgment in trading – there is no such thing. Your best approach is to stick with stock that you know and understand so you can make the best trades for yourself. Below you will find the differences between the two.

- Put Credit Spreads – These are bullish trades when selling a put credit spread. The trader should look for the put to lose value over time via theta decay giving them the advantage. The trader then should look to buy a cheaper put option that will offer them protection. For example, if a stock is trading at around $150 per share you would sell a $150 strike put while buying a $145 strike put as protection. As long as the stock trades above $150 per share, you will collect the premium.

- Call Credit Spreads – These are bearish trades, and selling a call credit would be your goal. For example, let’s say a stock is trading around $150 per share, you would sell a $150 strike call and buy a cheaper $160 strike call as protection. So long as the trade stays under $150, you collect the premium.

Trading Examples

Credit spreads are a great way to trade options if you are looking for a low-risk but low-reward strategy. But let’s go over what they are and how they can be applied.

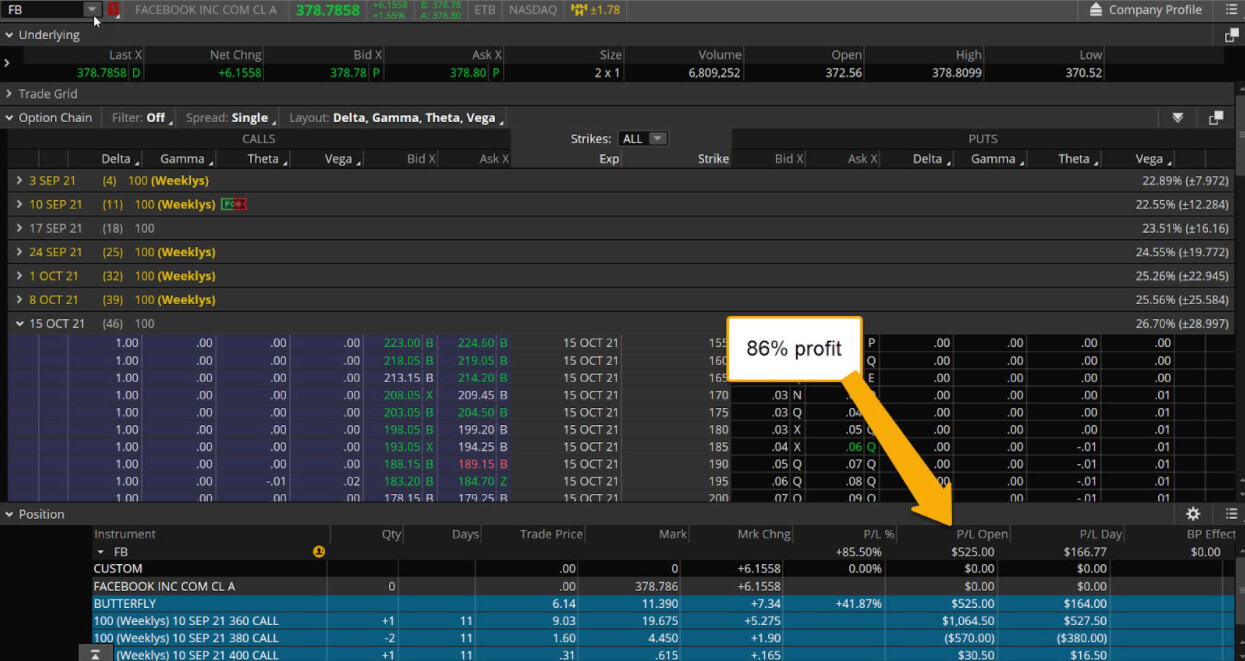

TESLA

TSLA is one of my favorite tickers to trade because there is always something going on, you don’t need a short squeeze or a crazy move to make money in this stock, you just have to get used to the moves and learn how to trade the wiggles. On this trade, it was a relatively quick move, just a nice jump above resistance – totally different than my normal, trend-following trades. I traded this because TSLA and I are great friends and we have gotten very familiar. I used my options chain + technical setup to trade this for a very quick, 73% gain that didn’t require a lot of risks!

This ticker is a great candidate for spreads. It’s expensive when it comes to long calls and it’s volatile, so it’s easier for a trader to use spreads, and your percentage gain as it relates to risk is actually better than if you bought expensive long calls.

Even though it seems like an effortless way to trade, I still had to do my due diligence. I needed to find stocks that worked well with my strategy and my setups, which is key to trading credit spreads. But I am also very experienced in this type of trading and it comes naturally to me.

If you are looking to grow your account consistently with options, join my Stacked Profits Mastery Program. You get monthly interactive live trading sessions, my real-time trades that are being made in the market, and my constantly updated spreadsheet where you get to follow along with my trades.

FAQs on Credit Spreads

A: Selling an iron condor spread means selling a call credit spread and put credit spread at the same time on the stock. You want the stock to trade between the options contracts you sell for maximum profit on the trade.

A: There are different instances where you would use a debit spread or debit spread. Selling a call credit spread can be the least risky way to play a directional chart.

A: Yes, in fact, anything in the market can be a potential loss if the proper research has not been performed. However, with Credit Spreads, the potential loss is the width of the strike price plus the premium that was received.

A: It is possible to be able to generate enough income to create a salary, however, research and commitment are key. Traders trading credit spreads need to understand that the most they can make is the net credit gained. So traders will have to calculate what is needed to live comfortably.

A: Traders make a profit by the net credit of a credit spread. The way traders get a net credit is the difference between the options premium that was paid for and the options premium that was sold. For example, a trader can pay for an option premium for $200 and sell an option and set the premium for $300. In this case, the net credit is $100.