Inverse Trampoline Setup

The market had a pretty rough day on March 3rd, but your accounts probably already told you that. I know mine did when all my stops got hit over the course of a few days. And with all that fresh cash burning a hole in our pockets, I know we were itching to put it to good use. The SPY seemed to have found a bottom when it hit the Daily 50 SMA, and many traders were looking to go long into that support. But I knew not to take the risk as that bounce we saw on Monday was right into what I call an Inverse Trampoline, and it was the exact short setup I was prepared for.

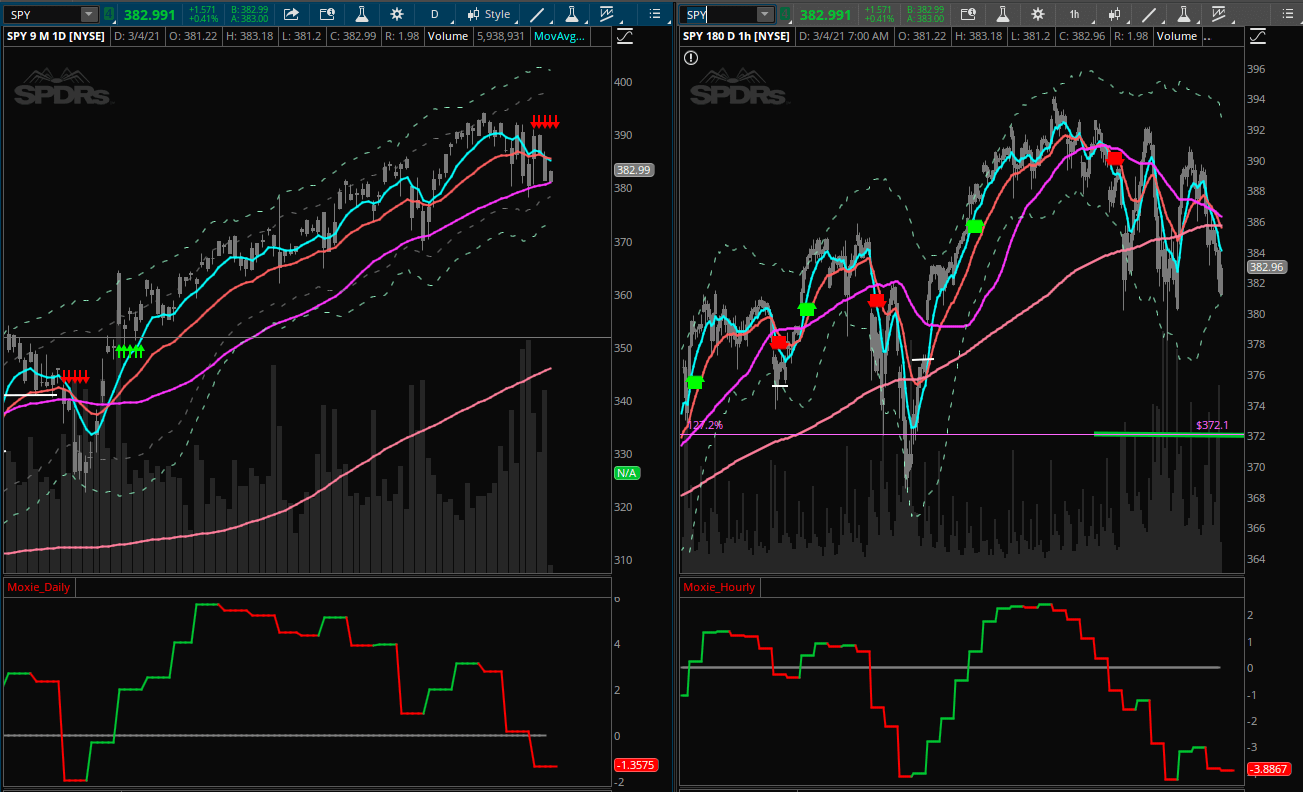

In the Moxie Indicator rule book, I have a configuration I refer to as an Inverse Trampoline. This is when price is over the 50 SMA while the Moxie Indicator is below the zero line. Sometimes, this can be a bearish short entry, other times it just keeps you out of a false long entry. In this case, it was one of the clearest short signals for the SPY we had seen in a few months.

Having experienced this a number of times in my trading career, I was able to guide my subscribers in staying away from long trades, into protection mode, and shorting the market if they so desired. As of Tuesday, going into Wednesday 3/3/21, I told the Moxie traders to not be long the market despite the bounce, and then once we saw the price begin to fail support at the 15 min 50 SMA, I told them I thought the SPY was going to the weekly 21 EMA or about $370.

As of this writing, the short side seems to be gaining speed in the overnight session and we could see some forceful moves downward today, Thursday the 4th. While this may be really painful and difficult to be experienced, it is a normal part of the market as we had an incredible four-month run. It was simply a matter of time until we got some sort of pullback and it sure looks like it is here. We will need to give it a few more days to run its course, but once it does, I think there will be wonderful opportunities to take advantage of, as long as you have enough capital sitting safely on the sidelines. It is imperative to have the right tools, like the Moxie Indicator with setups like the Inverse Trampoline so you know when to step aside and go into safety mode. I hope you all are doing well out there and are ready for when things shape up.

Here at Simpler Trading, we understand that trading can be overwhelming, but we have experienced professionals that can help. Check out my Moxie Indicator Mastery program for live trading sessions, real-time trade alerts, and more.