How Psychology Works in Trading

In this post:

- What is Dr. Van Tharp known for?

- What is the most important factor for success in trading?

- How long does it take to become a successful trader?

- What are the reasons some investors are likely to lose money?

When trading in the markets, there’s always another person on the other side of your trade filled with the same emotions as you. Trader emotions will always be the essential aspect of trading in the markets. Traders bring interest, fear, greed, and capital, contributing to the market moves.

As society is becoming more and more ingrained with A.I. and automation, for the time being, traders are still human beings. With our human nature, we bring emotion, anxiety, anger, fear, and joy. Traders are the only reason why there is a certain psychology behind trading. On the other hand, the market can care less about the will traders try to impose on the market. With every move up or down, psychology was applied by two sets of traders, the winners, and losers.

Human emotion is almost impossible to control; it’s essential to recognize the negative emotions that drive bad habits when stock trading. In this article, we aim to do that, so let’s jump right into it and go over the psychology of trading.

Video Guide on Trading Psychology

Are you ready to trade with a Community?

Simpler Trading understands the high-risk nature of trading in the stock market. Luckily, traders seeking mentorship and guidance who don’t know where to start can join us in the Simpler Free Trading Room. Traders like yourself can come together, trade alongside a professional trader, and learn valuable trading strategies in a live trading session. Sign up today and access the free trading room, recorded sessions, and free classes. Why trade alone when you can trade with us for FREE!

Trading Psychology

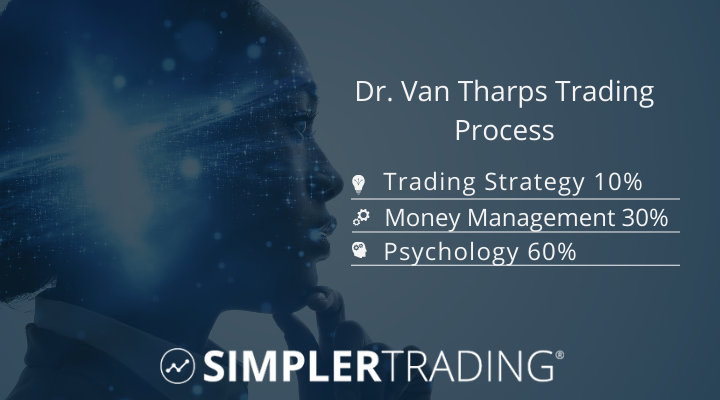

Dr. Van Tharp is a professional trading coach and founder of the Van Tharp Institute. He received his Ph.D. in Psychology from the University of Oklahoma. Dr. Van Tharp combined his expertise in psychology and finance to help traders overcome many psychological barriers they endure while trading. He is known for breaking down the trading process into three categories that affect traders.

According to Dr. Tharp, the psychological outlook and an individual’s thinking towards trading is the most critical factor for success. The fact that the actual trading strategy is ranked the least important by Dr. Tharp suggests that regardless of how successful a strategy is, psychology is the key to being successful.

The main reasons for the poor performance of individual investors are:

- Human Psychology: Individuals make daily decisions with their emotions assisting their judgment.

- Performance chasing: Investors who chase performance will likely lose money over the long term.

- Casino Investing: Many people think they can make money by winning the lottery.

- The “me too” lemming investment strategy: This is a common strategy of people who don’t know what they are doing with their investments.

- Fear and Greed Investing: Those are the most powerful motivations for investors. Unfortunately, investors tend to alternate between these potentially destructive emotions.

Trading Philosophy

Establishing a routine will be key in your trading career because everything in life requires balance, and trading in the market is no different. Traders need to set a time to trade, set a time to learn, research, enjoy life, and rest. Traders need to take care of themselves and have a healthy lifestyle to have a chance at success.

Exhaustion, frustration, and burnout are all real things traders need to be concerned with, as we need to be sharp and on our toes with every move, we make in the market. If we are not, losing money and our confidence will be a norm.

Dr. Tharp indicates three rules for successful trading:

- The first new rule is that trading is a profession as any other. It takes significant time (several years) and a deep commitment to becoming a successful trader.

- The second new rule is that trading reflects human performance just as much as any top athletic endeavor. You must understand that you are responsible for the results you get. Thus, you should devote significant time to working on yourself to succeed.

- The third new rule is that objectives are essential. Furthermore, you achieve your goals through position sizing strategies. The quality of your system just tells you how easy it will be to use position sizing strategies to achieve your objectives.

Most people don’t think about the most important objectives, except that they’d like to make a lot of money and avoid losing, but they don’t know one of the most essential aspects to trade, position sizing strategies. They learn that asset allocation is important, but they never understand that what makes it so important is the “how much” factor, which is what position sizing strategies are all about.

Trading Plan

Along with a routine, having a plan is crucial to trading. However, everyone’s trading plan will be different to some degree. Below is a general plan that traders tend to utilize in the market. Depending on how a trader trades in the market, a trading plan can be customized to fit how you trade.

Common trading plan:

- Diversify. That doesn’t mean buying 30 stocks instead of 5. That means implementing a mix of non-correlated strategies. No strategy will perform well under all market conditions.

- Find a strategy you like and stick to it for at least 6-12 months.

- Find a good trading community that can help you with your trading.

- Have a good plan

- Set your performance goals in years, not months or weeks.

- When trading a new strategy, paper trade for at least one month, then start small and gradually increase the allocation.

- Find a mentor that you can trust and follow them. Try to understand what they are doing. If you don’t understand the trade’s rationale and risks, don’t take it.

The stock market is a highly complex system that drives the world’s economy, but our human nature and psychology add to that complexity. As traders who have our own money and livelihood on the line with every single trade, we need to remember to keep things simple; have a trading plan, understand the trading psychology of every trade, and don’t deviate from your plan unless necessary.

If you are unsure whether your plan is solid, then consider joining Simpler Trading in the Simple Free Trading Room. Sign up today, and join a community of traders led by a professional trader who can guide and mentor you through a trading session. Along with the free trade room, you get access to recorded sessions and free classes where you can deepen your trading knowledge. Why trade alone when you can trade with us now for FREE!

FAQs on Trading Psychology

Some of the tips to master trading psychology are: find a strategy you like and stick to it, find a good trading community, set your performance goals in years, not months or weeks, and find a mentor that you can trust and follow

Some traders say that 60% of trading success is psychology.

“Dr. Van Tharp is known for breaking down the trading process into three categories that affect traders: trading strategy, money management, and psychology.”

A short answer would be: very important. Over the last 10 years, I’ve learned that what distinguishes successful traders from the 95% that fail is discipline.

A: Key components of building a trading discipline: have a trading plan, know how often you want to trade and what asset classes, choose a strategy, and stick to it.

Here at Simpler Trading, we understand that trading can be overwhelming, but we have experienced professionals that can help. Sign up today and join us in Simpler Free Trading Room for a learning center, live trading, and trade alerts. Don’t trade alone again.

Originally Published on: Oct 19, 2016

Updated: 6/16/2022