In this post:

- What is a game of relative strength?

- What is the major currency trading pair?

- What is the defense against dollar bears?

It’s easy to be a dollar bear… the buying power of the dollar seems to fall every year. The government runs a continuous and growing deficit every year regardless of who’s in control, and the Fed facilitates the largess with zero interest rates and monetization of the debt.

And they’d be right, to a point.

Forex is a game of relative strength. The trades work as currency pairs where one currency is bought and another sold. Imagine a seesaw with one currency rising causing the other to fall and vice versa.

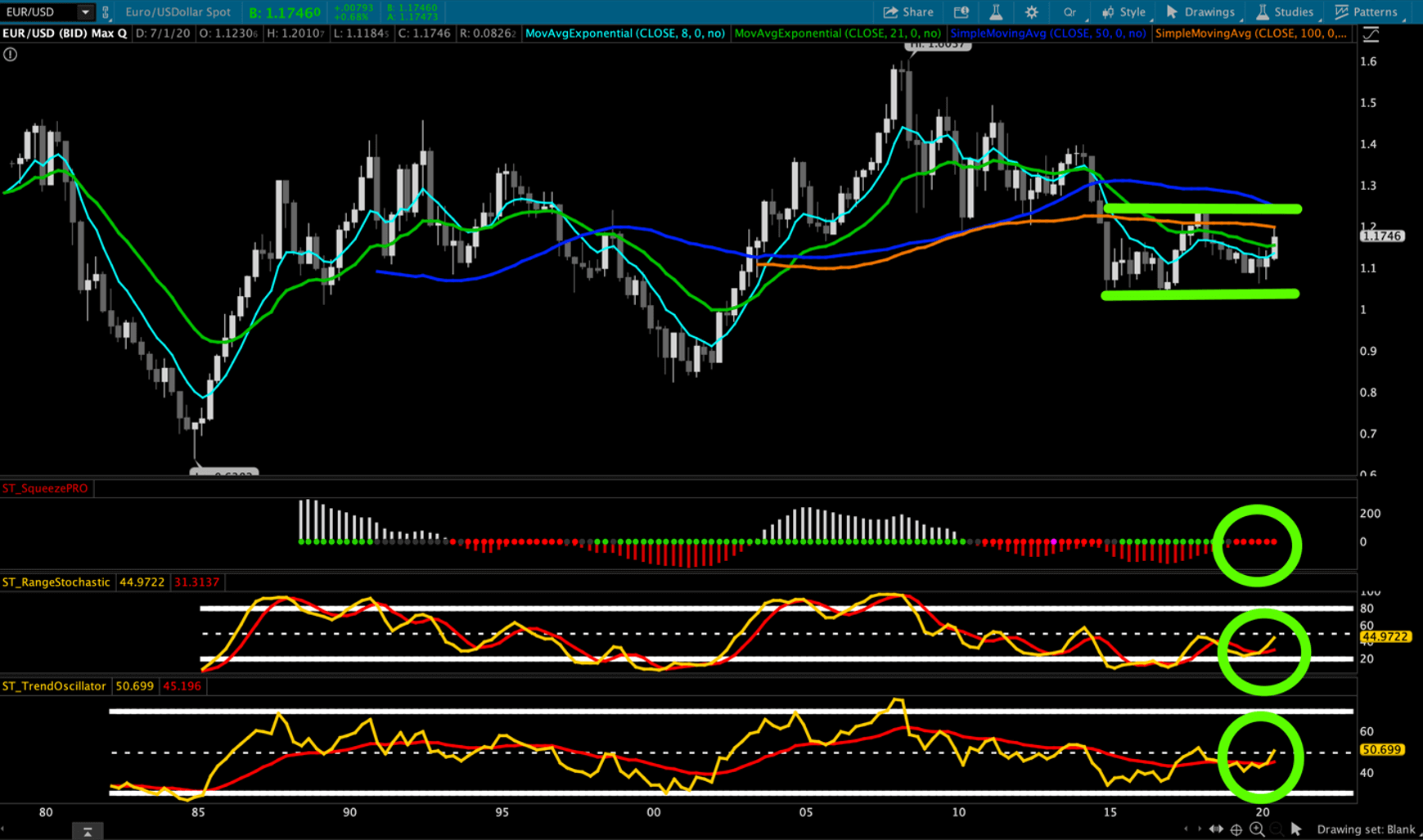

Let’s take a look at the current quarterly chart of EUR/USD, the largest trading pair.

It would seem the bears have their setup: an ultra long-term chart with a trading range, a higher low, a squeeze, and momentum indicators attempting to reverse.

The implications of a quarterly squeeze trigger could last years. It won’t be easy as there are significant resistance levels overhead, but the setup is there.

If this setup fires long, it implies a higher Euro, which would drive the USD lower against the EUR and likely all other currency pairs.

Stocks would most likely appreciate this as inflation proxies would soak up the inflationary effects. Metals and crypto would also like this in terms of price.

Pretty much any financial asset priced in dollars, I would expect, would rise in price if this setup fires long in an orderly way.

So, what’s the defense against the dollar bears and this setup?

I won’t pose the defense against the setup, as the technicals speak for themselves. Bulls have the ball in terms of accumulation/squeeze building, and in terms of higher lows and some positive momentum crosses. Bears, however, have the ball in terms of major overhead resistance levels.

It is entirely possible that the setup fires long. We see all of the implications in stocks, metals, real estate, and bonds, and the dollar bears are still wrong long-term.

However, there are some factors that not everyone is familiar with which will keep the dollar buoyant.

The dollar is a debt instrument. As such, every time a dollar (physical or electronic) is created, a debt is also created. Every dollar that exists, and will ever exist, has been borrowed into existence.

Let’s look at a simplified example to find the problem… Bank A “creates” $100 electronic dollars and credits the end user.

The way this looks on the ledger is that Bank A has a $100 asset on its book in the form of a promise to repay by the end user. In return, the end user has $100 in their pocket to spend.

Seems balanced, right? Not exactly… what happens after one year when interest on the newly created $100 is factored in? We could say that after a year the end user still has $100, but now owes $101 to the bank after interest is factored in.

Where does that extra $1 in interest come from? It would have to be created using the same process as before.

Therefore, there will always be more debt in the system than there are dollars… this isn’t a bug, it’s a feature.

So, let’s go one step further… if new debt “creates” new money equivalents, then paying back existing debt “destroys” money. That’s where deflation comes from.

Therefore, additional debt creates a synthetic dollar short as when those debts are repaid, they will need to be repaid with more dollars in the future.

Let’s round it all out now… there will always be more debt in the system than dollars to cover the debt. Any new money will also be borrowed into existence and interest on debt will be funded in the same way.

When this is reversed, we see deflationary effects as repaying debt destroys dollars.

In conclusion, we get to an end point where we can understand that there is an implied potential at any time for a massive short squeeze in the dollar.

If folks start repaying debts en masse, like during a financial crisis, it “sets up” the potential for this massive dollar short squeeze.

The dollar in the near term may go up, down, or sideways… the quarterly chart is certainly set up in the proper way to break down for 1-2 years in a big way… however, the mechanics of the market favor the dollar in the long run.

Don’t believe the people that say the dollar is going to zero or will rapidly fall.

It’s easy to be a dollar bear, but the question to ask them is why they are so bullish on the Euro?

That is how the system mechanically works.