Bullish, bearish, chop… ETFs are your edge!

Many traders overlook the Exchange Traded Funds otherwise known as ETFs. But what does ETF really mean? Until you grasp what symbols make up an ETF and how to trade ETFs, you’re going to be missing out on some great opportunities.

What Are ETFs?

An ETF is a basket of stocks that are often broken down into sectors. A sector is marked by stocks that are related to each other in a certain category.

For example, stocks such as Proctor and Gamble, Coke, Pepsi, Walmart, and Costco are put into the ETF XLP, which is referred to as “consumer staples” – basic or necessary items and services that consumers commonly use. The stocks themselves are also symbols that we commonly trade.

ETFs tell us not only what’s happening at a specific, say granular level in stocks, but also what’s happening in a specific sector. We can see where there’s participation and who’s buying what.

There are literally thousands and thousands of ETFs, but there are really only a few of them that are becoming more and more influential.

The difference between indices – the S&P, Dow, etc. – and ETFs is that ETFs are often categorized by a sector in the markets. Let’s look at some of the most influential ETFs:

- Financials (XLF)… Berkshire Hathaway, JP Morgan, Bank of America, Wells Fargo.

- Healthcare (XLV)… Johnson and Johnson, United Health, Pfizer Abbott.

- Consumer Staples (XLP)… Proctor and Gamble, Coke, Pepsi, Walmart, Costco.

- Technology (XLK)… Apple, Microsoft, Invidia, Salesforce.

Notice the super common names that we love to trade, but we don’t necessarily look at collectively.

How ETFs Work – Avoiding Common Mistakes

We commonly make the mistake of pitting these symbols against each other. In reality, the sectors give us a bird’s eye view of what’s happening in the market.

ETFs provide us the transparency to understand what’s going on. Following ETFs prepares us for chop and every other market condition out there including downtrends and of course, uptrends.

Let’s face it, the markets are always going to change. We just need to adapt.

How does that work? When you’re looking at these sectors, you can see where the money is going by measuring the volume and price of each ETF. This gives you a major advantage over traders looking at only the broader averages in the indices.

This is the edge you can use to decide what you should be looking at and equally what you can have the confidence to stay away from. Knowing what to trade is equally as important as knowing what not to trade.

These ETFs will help you direct your way through the equities markets, by seeing stocks on a more specific, granular level without (and this is the part that I love) having to go through thousands of symbols and even worse, disconnected symbols. These are symbols that you’re really not certain why they’re moving and with what other symbols.

Why Trade Options On ETFs?

Trading options on ETFs can reduce your risk. Putting less of your money on the table means you’re risking a lower percentage of it. You can enter at a lower cost but have higher potential return because you can specify the markets that have the likelihood of moving in a more predictable way.

And with lower cost options, smaller accounts can take advantage of these market moves.

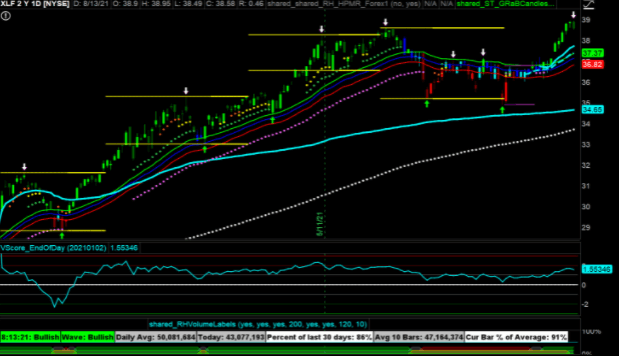

Let me show you an example of what I mean. This is the XLF.

In this trade we bought options for $255.00 per contract. Certainly that low cost works for any account size. How did we figure that out? Well, if you have a $10,000 account and you don’t want to risk more than 5% of your account you could’ve bought 2 contracts, meaning you’re risking $510.00. If you have a $100,000 account, and again not wanting to risk more than 5% of your account, you could’ve bought 20 contracts meaning you were risking $5,100.

We ultimately closed out at $860.00 per option. Let’s do some math based on the same examples as above.

- The $10,000 account bought 2 contracts… potential earnings are 2 x $860 = $1,720.

- The $100,000 account bought 20 contracts… potential earnings are 20 x $860 = $17,200.

Not bad for risking $500 or $5,000. This trade was a 237% winner.

Could you have done the same thing trying to individually trade Berkshire Hathaway, JP Morgan, Bank of America, or Wells Fargo. Maybe, but your risk and cost would’ve been very different.

Trading options on ETFs is an edge so few traders use because they simply don’t know how to look at the sectors and use them when creating their watchlists and making their trades. Now you know the difference.

In my Sector Secrets Mastery, this is the way we trade the markets. We start by looking at the indices, move on to ETFs, and then take a look at the individual stocks, learning how to look at the big picture to direct us to what symbols should be on our watchlist and traded. Come join us!