David & Neil’s Trend Spark Indicator

How David and Neil automatically

identify trends and reversals on any chart

Struggling to find clear setups in this fidgety market?

Check out David and Neil’s system for futures, stocks, currencies, and even crypto

This is your opportunity to follow David and Neil as they use their breakthrough system to automatically identify entries, exits, and stops on any chart.

The market’s been pretty complex lately. Everyone’s either fighting against the fear of missing out (FOMO) while looking for more clarity on their charts.

That's why these two expert traders want to show you how they’ve been able to comfortably get in and out of short-term intraday trades (without having to “wing it”).

In fact, let's look at these two identify intraday setups precisely with David and Neil’s co-developed tool, Trend Spark.

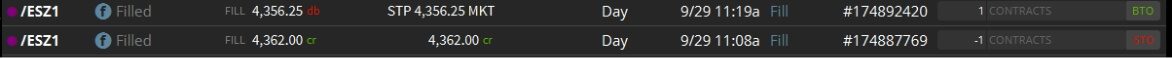

ES Mini Short Trade Yields $287.50 Per Contract in 11 Minutes

ES Mini Short Trade Caught $1962.50 Intraday Gains

GOOGL Short Trade Banked $1830 Per Contract in 90 Minutes

Note: These were all real trades executed in live-market conditions.

As you can see, Trend Spark worked in down market conditions. Of course, the same strategy works the same way during uptrends.

Who is this for?

Trend Spark is so simple. You use only TWO charts. One identifies the trend, and the other triggers entry and exit signals

Traders who want to stay in a move without second-guessing. No to mention, also for traders who own Trend Spark.

What’s Trend Spark? It’s so simple. You use only TWO charts. One identifies the trend, and the other triggers entry and exit signals.

Identify the dominant trend on any timeframe

Pinpoint precise entries as early as possible (while filtering out noise)

Provide objective points to jump into larger trends

Catch reversals at the most advantageous levels

Reveal where to cut losses when a move doesn’t work out

Give automatic trailing stop levels to allow for larger potential gains

The Trend Spark Indicator

Imagine knowing the current trend on any chart at a glance…

Next, imagine having clear, objective entry and exit points that plot in real-time. That’s when you can spot trend trades without guesswork or “analysis paralysis”. That’s exactly what Trend Spark is designed to do…

What makes this new indicator even more powerful is that it can be used as a complete stand-alone system or complement your existing strategy.

Trend Spark not only plots entries and exit targets, it also identifies objective stops levels. These automatically generated levels help you to know when to cut a losing trade.

Even better, Trend Spark automatically reveals where to trail stops, making it crystal clear when to scale out with profits.

Now, David and Neil use Trend Spark almost exclusively on intraday futures like the ES, YM, and NQ. However, it can be applied to almost any symbol or timeframe (including stocks, ETFs, crypto, and currencies).

Currently available on:

*TradingView does not support tick charts so users of this platform cannot replicate every chart which Neil and David use.

Here is what others are saying about the Trend Spark Indicator:

@Big Bad Voodoo Daddy Geez man!! Trendspark is an amazing scalping tool! Easiest tool I've had to find setups. Big thank you!

-Mitch H

Trendspark makes me not as jumpy

-Jules

@Debbie well of course i have the HPMR and the RAF and now the new toy is Trend spark. I love the TSpark on future pairs. i just tried it this morning for day trade on USDCAD...wowza...nice toy.:)

-Lise

@Big Bad Voodoo Daddy I got Trendspark yesterday and it is a game changer

-Cherie

@Big Bad Voodoo Daddyy Loving the Trendspark David!

-Leslie L

Who is David Starr?

David is Simpler Trading’s “Mad Scientist.” He is the creator of the popular Voodoo Lines(r) and Ready, Aim, Fire! indicators. A trained theoretical mathematician who later took his MBA first in his class, he now trades full-time in addition to helping Simpler Trading clients achieve their own success. Many might consider David’s academic achievements and his experience as a strategic management consultant, building companies, and taking them public, to be some of the most respected as ideal preparation for success in financial markets. However, he is passionate in stressing that the key to trading success is understanding and managing one’s own emotions.

David’s consulting clients prize his ability to provide customized insights into unique business situations. In the same way, traders who have taken David’s classes or listen to him daily in the Simpler Futures room use his insights to take their trading to the next level. David understands that the same trading style which might allow one trader to approach markets in a calm, collected manner is ideal for reaping profits. Be that as it may, this might provoke the emotional demons that incite account-destroying behavior in another.

Generally, more experienced traders are able to quickly assimilate the trading lessons. David shares his trading lessons and his talent for solving problems in new and refreshing ways. Yet, traders of all experience levels make use of his technical indicators and the out-of-the-box thinking which can lead to their development.

Even if you don’t yet use one of these tools, you might be surprised to learn that you already make use of his technology on a regular basis as his patented innovations in wireless technology are inside virtually every smartphone on the planet.

For his own trading, David relies heavily on Elliott Wave analysis, sharing his insights into market trends nightly in his Elliott Wave dispatch and interacting daily with the traders in the Simpler Futures room. Viewed by many as too complex, arcane, or unreliable to use regularly, again our Mad Scientist has his own out-of-the-box approach. David regularly hears from clients that his “language of the market” analogy, which describes how Elliott Wave is a language markets use to communicate with us, finally made this style of analysis easily understandable and that his Elliott Wave analysis of markets provides them actionable trade ideas.

Even with a more accessible approach, not every trader wants to learn about Elliott Waves. So, David went into his lab and found a way to turn Elliott Wave analysis on its head and make all of its weaknesses into strengths. Too many people abandon the style of analysis, viewing it as too subjective or only accurate in hindsight. If everyone agrees it’s accurate in hindsight, David thought, “let me create a tool which projects current prices from waves that occurred long enough in the past that there’s no argument about the pattern.” Voodoo Lines was the result and not only do traders love how magically it tends to find support and resistance, but they also appreciate that all they have to do is look at lines on a chart without any complex wave knowledge required.

Who is Neil Yeager?

Neil is our intraday futures, currencies, and commodities trading expert and statistician. He has a wealth of knowledge about the markets. His combination of market profiling, Japanese candlesticks, and statistical data he pulls from personal studies he conducts on the /ES will improve your knowledge of the markets immensely. He is methodical and conservative in his entries and has excellent risk to reward ratios on his trades. Neil’s strategies are strengthened by statistical modeling and backtests. If you’re trading futures, you can’t miss Neil’s daily analysis in the Futures Gold Room. Even if you don’t trade futures, his statistical approach to market analysis is sure to improve your trading.

Keep in mind that the trend is your friend. So start by asking what does the market look like it is doing, and how is it doing in accomplishing that. A product that is trending in an easier manner is the one that we want to be involved in. Try to avoid the choppy markets unless intentionally employing an associated options strategy. In joining a trend, try to utilize a retracement to the mean approach with a specific setup criteria that allows for the ability to predetermine the required risk for participation. Measure that risk against the desired objective, and with an acceptable R factor, then we have a trade. This very next trade has only one of two potential outcomes. It is either a win or a loss, so log it, track the metrics, and move on to the next. The trade setups that provide a positive expectancy are the keepers. Negative expectancy setups are set aside to be revisited at a later date as market conditions eventually change.

Since graduating from the University of Alabama with a degree in Finance, Neil has been employed in various roles from sales to accounting. He has also been a successful business owner, but nothing has been more challenging or rewarding than this current path of navigating the financial markets. A general rule of thumb from Neil? Follow the rules (risk management), and the markets will reward you generously. Your time and freedom can be your own when desired, as the markets are open for business again tomorrow.

Frequently Asked Questions

Have Questions?

Our support staff is the best by far! You can email [email protected] or call us at (512) 266-8659